Irs Schedule A 2024 Code – Tax season is officially here, and the people who are in the best shape to minimize their tax bills, maximize their refunds and get every available credit and deduction are those who started 2023 . “Interest on a home equity loan is tax deductible if the money is used on renovations that substantially improve the home,” says Banfield. So, if you use the money you borrow with a home equity loan .

Irs Schedule A 2024 Code

Source : thecollegeinvestor.comAmazon.com: Get Me to ZERO™: Use the 2024 I.R.S. Tax Code to Pay

Source : www.amazon.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduWhat Is IRS Form 5498: IRA Contribution Information?

Source : www.investopedia.comAmazon.com: Get Me to ZERO™: Use the 2024 I.R.S. Tax Code to Pay

Source : www.amazon.com2024 Benefits Breakdown: Your Wallet Will Thank You! – Total

Source : totalbenefits.net3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govNews Flash • Lorain Income Tax Department

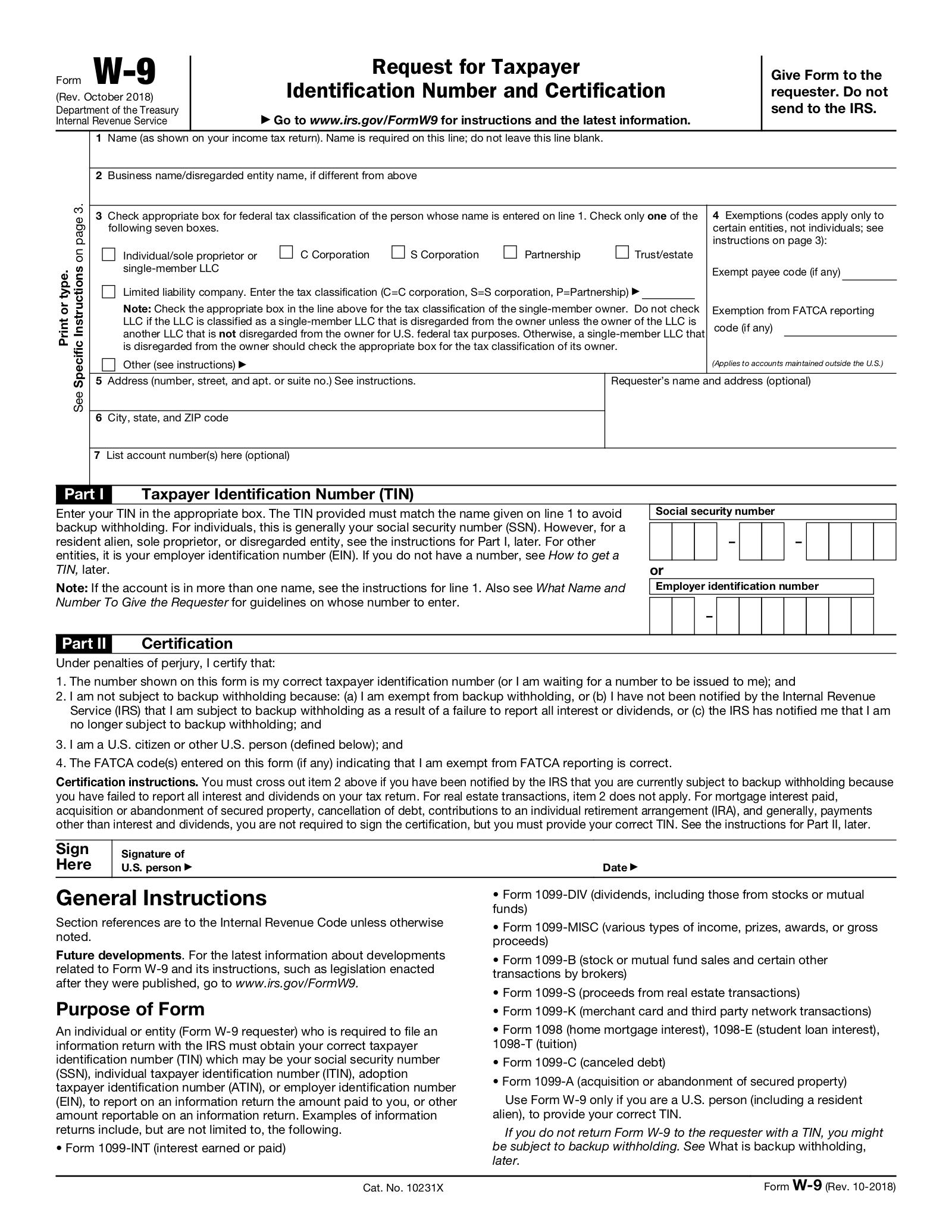

Source : www.cityoflorain.orgFree IRS Form W9 (2024) PDF – eForms

Source : eforms.comComplete Internal Revenue Code (Winter 2024 Edition) | Law Firms

Source : store.tax.thomsonreuters.comIrs Schedule A 2024 Code When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: there is no guarantee that will also be true for the 2024 filing season, and employers should be prepared to address any obligations they may have under Code section 6050W to issue 1099-Ks at the . The best tax software can help you file your federal and state tax returns easily and without having to shell out big bucks. In fact, many online tax prep tools featured on this list are free for .

]]>

:max_bytes(150000):strip_icc()/Form5498-135715bd358f41ed99042ea66213b504.png)